What KoinWorks is going to do with late payments & NPL? See the complete information in this article.

Daftar Isi

- Late Payment

- Default / NPL (Non-Performing Loan)

- Provision Fund

- 1. What does KoinWorks do to Borrowers who fail to pay after the Provision Fund disbursed?

- 2. If the Provision Fund has been disbursed, what will happen if the Borrower continues its payment obligations?

- 3. How do I find out which loan has defaulted?

Late Payment

Installment Repayment Type (repaid monthly) & Lump-sum Repayment Type (repaid at the end of the tenure)

For both installment and Lump-sum type of repayment, the lender will get an extra 0,05% per day as a late fee.

Due to daily calculation and the possibility of bank processing delays, lender will get the late fee maximum of 3 (three) working days after the successful borrower’s payment date.

For example, the due date is 1 January and the borrower’s payment date is 2 January but in this case, there is a bank clearing issue that caused the money to be received on 4 January.

Therefore the calculation for the late fee is 1 day (From 1 January to 2 January)

Default / NPL (Non-Performing Loan)

If the borrower is unable to fulfill their obligations either partially and/or wholly in accordance with the Credit Agreement for a maximum of 180 days, the loan will be marked as NPL.

If the repayment is late or NPL, our internal collection team will try to collect the debt with good intentions and practices as OJK suggested to us.

Provision Fund

As part of our commitments to prioritize lender’s safety, KoinWorks with PT Lunaria Annua Kapital provides a provision fund to minimize loss for lenders, if NPL happens.

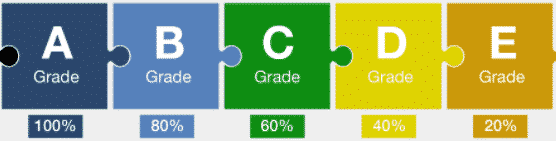

As written on the image above, we will provide protection for your capital (interest won’t be included):

- 100% capital protection for grade A loan,

- 80% capital protection for grade B loan,

- 60% capital protection for grade C loan,

- 40% capital protection for grade D loan

- and 20% capital protection for grade E loan.

1. What does KoinWorks do to Borrowers who fail to pay after the Provision Fund disbursed?

KoinWorks will continue to bill the relevant Borrowers.

2. If the Provision Fund has been disbursed, what will happen if the Borrower continues its payment obligations?

Refunds obtained if the Borrower continues to pay will be returned or allocated to the Provision Fund in order to minimize capital losses from other loans that may default again.

3. How do I find out which loan has defaulted?

On the Lenders dashboard page, please refer to the Portfolio menu.

In it, each Lender can see the performance of each loan.

Lenders can also see loans that have failed to pay with a red indicator and the Protection Fund indicator when it has been disbursed.

More details can be seen when by clicking the Notes button.