As of June 7, 2024, we will implement a new NPWP verification feature in collaboration with Pajakku, which is directly connected to the Directorate General of Taxes (DGT).

This update will ensure accurate tax withholding rates based on your NPWP verification status.

WITHHOLDING TAX RATE:

- Verified NPWP (WNI): 15%

- Unverified NPWP (WNI): 30%

- Foreign Nationals (WNA): 20%

Previously, as long as the NPWP column was filled in, the withholding tax rate was 15%.

However, with this new verification system, those whose NPWP cannot be verified by DGT will be subject to a 30% withholding tax rate.

For example, if a wife uses her husband’s NPWP data, she will be charged a 30% rate if the NPWP does not match or cannot be verified.

REQUIRED ACTIONS:

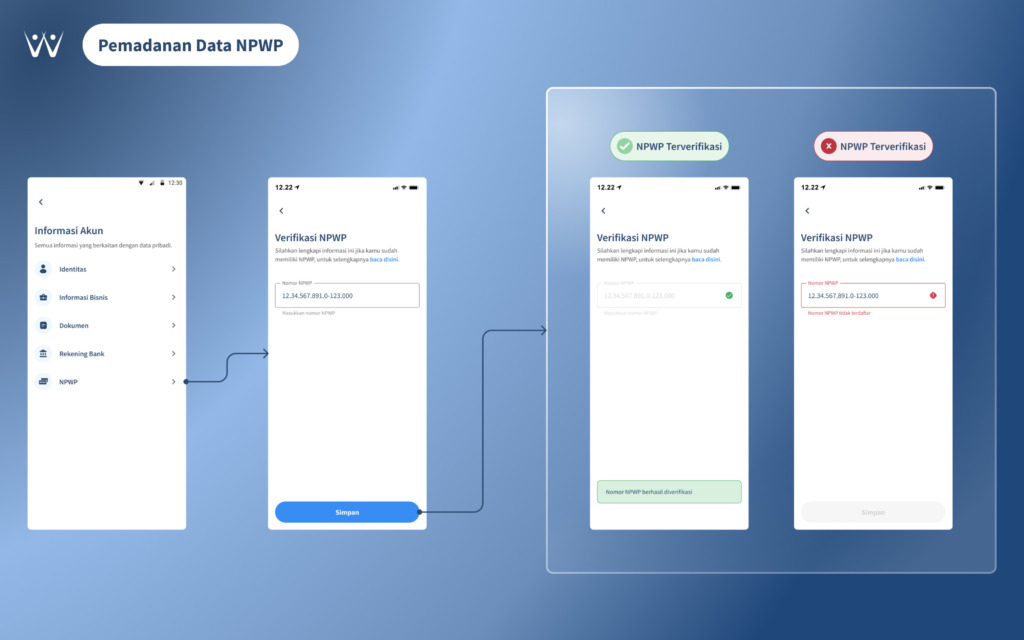

To ensure you are subject to appropriate taxes, please match your NPWP in the following ways:

- Go to Profile > Account > Information NPWP

- If your NPWP column cannot be edited and has a green check mark, it means that your NPWP has been verified.

- If your NPWP column can be edited, it means that your NPWP has not been verified.

If your NPWP has not been verified, please update it immediately to avoid higher withholding tax rates.

Immediately match the data to ensure your NPWP is correct and verified.

If you have any questions or need assistance, please contact our customer service team at 150588.