- There are signs that an economic recession is imminent, according to Bank of America. Financial institutions look at the 150-year history of recessions and warn that 2 signals have emerged: an uphill yield curve &; tighter credit.

- Indonesia’s economic indicators are doing very well despite two US indicators signaling a recession.

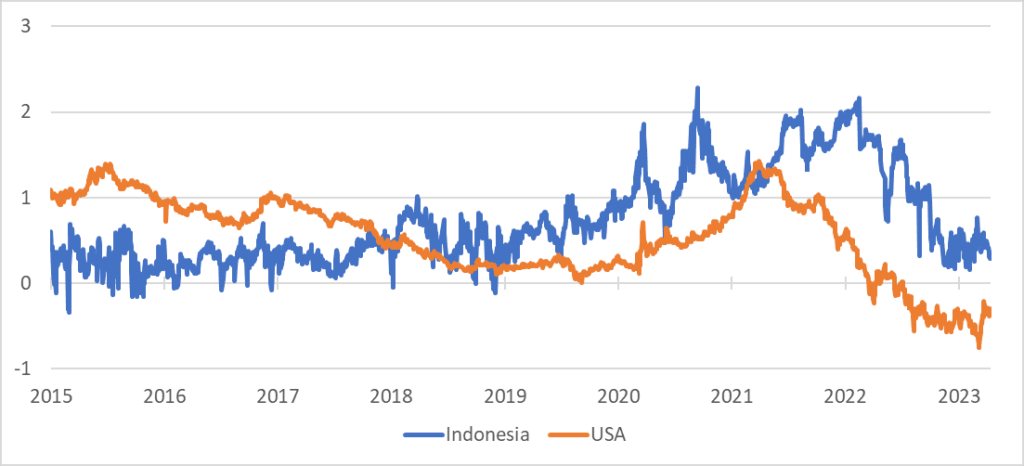

A decline in the yield curve of Government Bonds has long been considered a reliable signal of an impending recession.

According to Bank of America (BofA), eight out of ten declines in the yield curve since 1921 signal an impending recession. In addition, when the yield curve climbs and a sharp decline is followed, it usually indicates that a recession is only a few months away.

On the contrary, the Indonesian economy bucked this trend, with the performance of Government Bond yields outperforming the United States (US).

US VS Indonesia 10T Minus 3T Yield Curve

Recently, the US has experienced a decline in the yield curve, with the 2-year and 10-year yield curves climbing from a peak of negative 1.07% to negative 0.54% today. On the other hand, the yield performance of Indonesian government bonds is relatively better.

Short-term government bond yields rise 50 basis points (bps) compared to the level at the end of December 2022, indicating a positive trend in the country’s economy. In addition, long-term government bond yields remain under control, further demonstrating the stability of Indonesia’s economic situation.

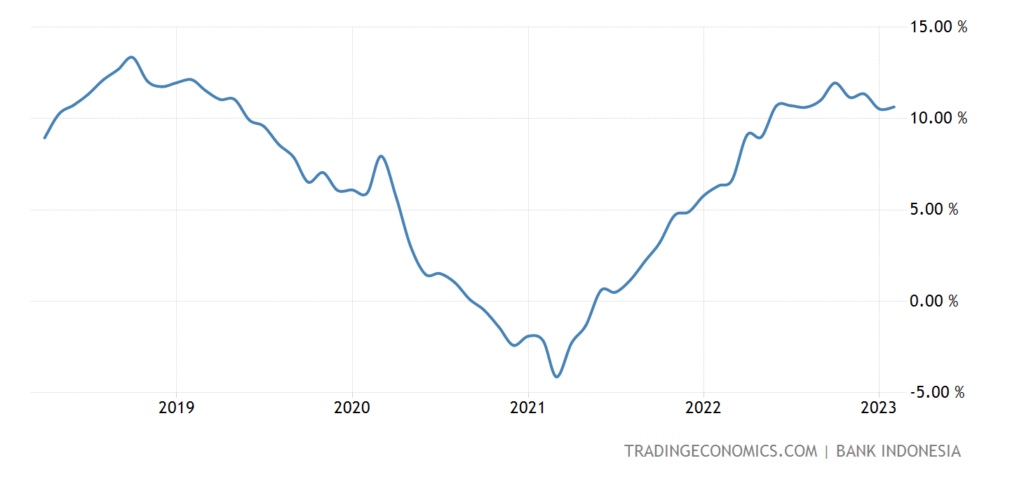

LENDING CONTINUES TO GROW

Indonesia’s Credit Growth

Indonesia’s economy is showing positive signs of recovery in line with the strengthening of the bank intermediation function, which supports efforts to stimulate economic growth.

Based on the latest data, credit growth in February 2023 recovered in all sectors, with an increase year-on-year (YoY) from 10.53% in January 2023 to 10.64% in February 2023.

A rebound in credit growth is a positive development that can boost economic growth and create more opportunities for businesses and individuals.

Access to credit is essential for businesses, especially MSMEs, to expand their operations, invest in new technologies, and create jobs. This supports the government’s efforts to strengthen the economy and promote inclusive growth.

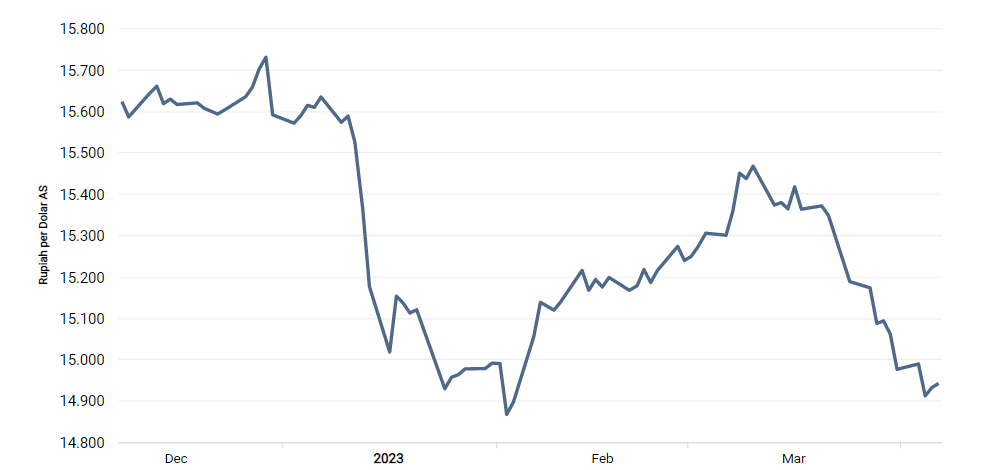

BANK RUN BRINGS STRONGER RUPIAH

Exchange Rate of Rupiah to US Dollar

The recent collapse of Silicon Valley Bank (SVB) and Credit Suisse is not expected to have a significant impact on Indonesia, as there has been a general negative sentiment towards global banking withbearish signs on global stock markets following the bank’s collapse.

Indonesia has shown positive macroeconomic indicators through March, including a balance of payments surplus, economic growth, and inflation. As of 31st March 2023, Bank Indonesia reported Foreign capital inflows reached Rp10.97 trillion.

With the influx of foreign investment into Indonesia, the rupiah exchange rate against the US dollar strengthened to a level of around Rp14,900/USD in March.