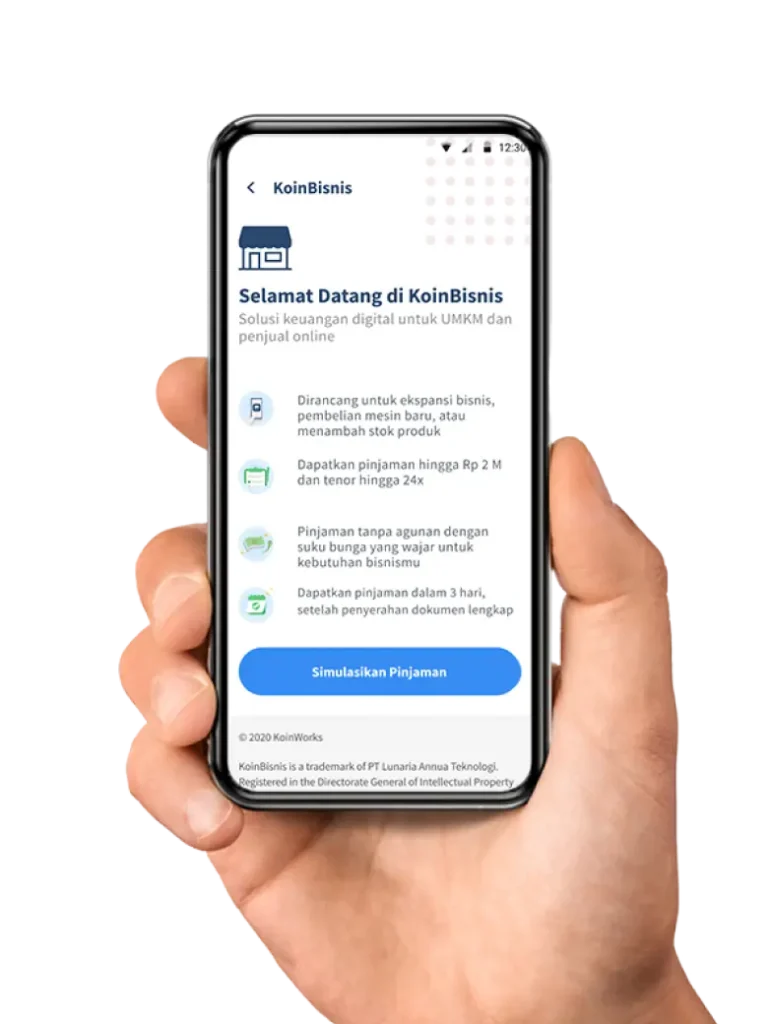

Grow Your Business with Business Loans up to Rp2 Billion

Term Working Capital Loan from KoinWorks, Designed for Your Business Growth

- Business Loan up to IDR 2 Billions

- 6-24 months Flexible Tenor

- Easy to apply and disbursement

- Unsecured Loan

- Flat Interest Rate. Transparent Fees

Find the Right Steps for Your Business Needs

Choose the Loan Product you want, according to your business needs

Check your credit score, get a business loan up to 2M

The better your credit score, the better your chances of getting a loan of up to 2 billion with low interest starting from 0.75%.

Requirements to become a Dream Warriors

It’s easy, just need to fill in personal data & ID card!

Requirements to become a Dream Warrior

It’s easy, just need to fill in personal data & ID card!

Business runs for at least 2 years

Borrower’s Age 21-60 Years Old

ID CARD

Business Account Report/Documents

NPWP (for loan that starts from IDR 50 mio)

NIB/SKU (Business License Number/Business Certificate)

Have a question? contact us via WhatsApp

3 Simple Steps to Do Funding on Your Personal Account

-

Download Apps

Download KoinWorks application on Playstore and get convenience in getting a business loan -

Register as a Business Account

Register as a business account and get the convenience to grow your business through a business loan -

Fill & Complete Documents

Complete the required documents correctly and KoinWorks Team will immediately verify your business account

Success stories from Dream Warriors

Stories from our community and clients who have lived the mantra #SatuKlikUntukWujudkan

Frequently asked questions

What is an online loan?

Online loans are loans provided online through online loan platforms or applications. This loan is usually quick and easy, because the application and approval process is done online without the need to come to a bank or other financial institution.

What is an online loan application?

An online loan application is an application designed to facilitate online loan applications through mobile devices such as smartphones or tablets.

What are the types of KoinWorks online loans?

KoinWorks has various loan products according to your needs such as KoinBisnis, KoinGaji, KoinInvoice and KoinPaylater.

What are the reasons for choosing KoinWorks loan products?

Reasons for choosing KoinWorks loan products:

- KoinWorks Security Guarantee is licensed and supervised by OJK and ISO 27001 certification.

- Registration in one application equipped with excellent features for MSMEs.

- Competitive and transparent interest rates.

- Unsecured business capital loan.

- The amount of funding is up to 2 billion and the tenor is long up to 24 months.

- The funding process is quick and easy.

Is it difficult to apply for a loan at KoinWorks?

No, the requirements are very easy for the online loan application process at KoinWorks:

- The business has been running for at least 6 months.

- Prepare the borrower’s ID card.

- Prepare NPWP (If borrowing starts from 50 million).

- Borrower Age Range 21-60 Years.

- Proof of Business Account.

How to apply for a loan at KoinWorks?

Follow these steps to apply for a loan:

- Download KoinWorks App here.

- Register as a business account.

- Fill out and complete the document.