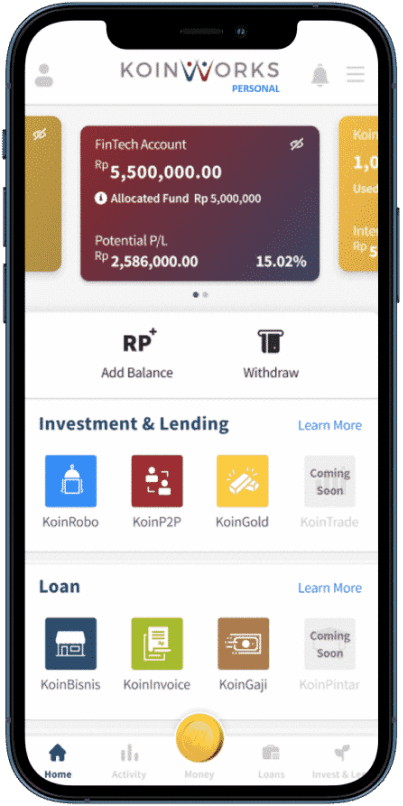

Get business capital funding of up to 2 billion with a flexible tenor of 6 – 24 months, flat interest rates with transparent fees, loans without collateral, easy to apply and disburse.

Learn 7 signs that your business needs additional capital to grow.

KoinBisnis is a business capital loan product intended for business development and empowerment of MSMEs in Indonesia that has been registered and supervised by the Financial Services Authority (OJK).

You can get access to loans for business development up to Rp2 billion.

Get a business capital loan easily, quickly and without collateral.

Get access to funding of up to IDR 2 billion for all your business development needs.

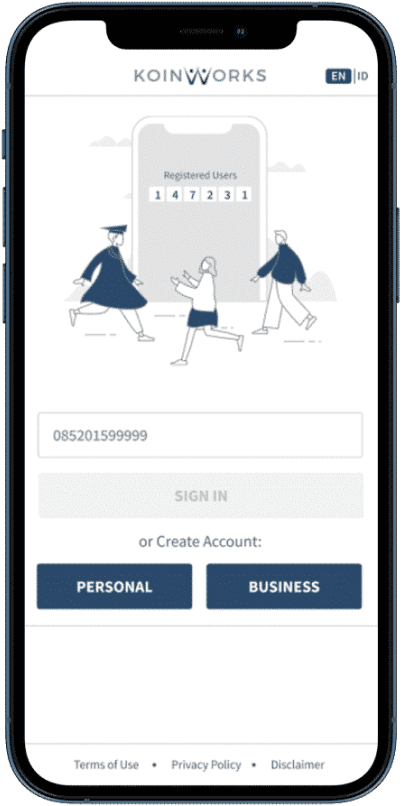

The application process is easy and fast through one KoinWorks application.

Interest is competitive, transparent, and with no hidden fees.

Various reasons to borrow at KoinBisnis that will definitely make you safe and comfortable

KoinWorks is also listed as a Inovasi Keuangan Digital (IKD) organizer.

Business Account, Money Transfer, Investment all in one app

KoinWorks has ISO 27001 certification. All transactions are guaranteed safe with a sophisticated and reliable security system

Customize your app for #WujudkanImpianAnda right away.

Try it now and get the benefits instantly

Install KoinWorks app and register yourself as a Brand Account

Select KoinBisnis menu and complete the data to start your loan application

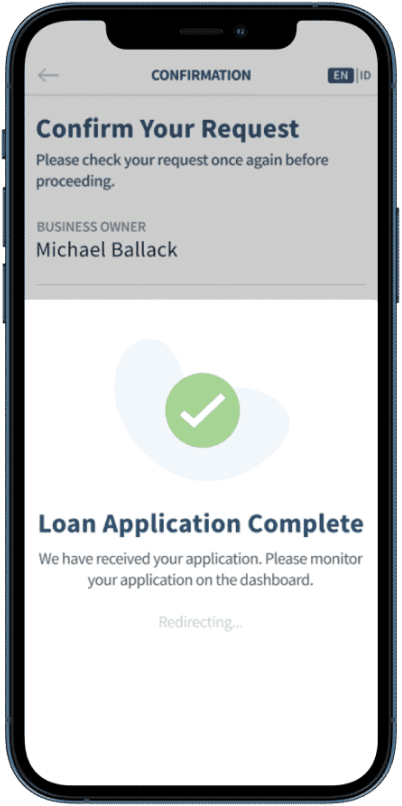

After completing the data, you can start applying for a loan for your business

After approval, your loan application will appear on KoinBisnis’s funding list

After collecting funding, we will send it directly to your account

Easy and transparent process for you to #WujudkanMimpiAnda.

Borrowers apply for loans online via the app

KoinWorks analyzes all data and assigns credit score A - E

Loans are issued into the marketplace

Hundreds of thousands of Funders analyze loans and fund them

Loan funded at least 80% and disbursed to Borrower's account

Borrowers utilize it and pay installments according to the tenor

The KoinWorks system automatically distributes returns to Funders based on the funding portion of each Funders (Principal + Interest)

All fees are transparent, goodbye hidden fees!

Interest/month

Credit approval fee

Life Insurance

Administration fee

KoinBisnis is a loan product intended for business development and empowerment of MSMEs. Get business capital funding of up to 2 billion, low interest, no collateral and easy submission through the application.

Reasons for choosing KoinBisnis:

No, the requirements are very easy for the KoinBisnis business capital loan application process. You only need to prepare the following documents:

For Home Business:

For Companies:

Follow these steps to apply for a KoinBisnis business capital loan: