The new service from KoinWorks provides a one-stop shop for 65 million SMEs that have not been reached by the conventional banking system.

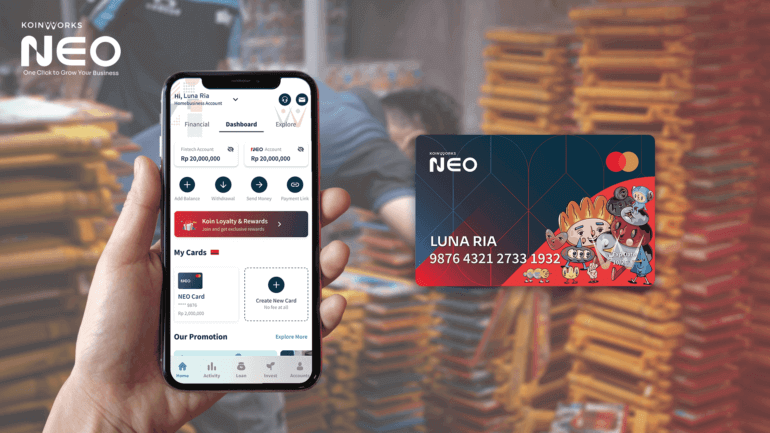

Jakarta, Indonesia (29 April 2022) — The rapidly growing digital economy requires the latest development models and technologies to support it. KoinWorks as a leading fintech in Indonesia two weeks ago announced the launch of KoinWorks NEO and NEO Card with the tagline “One Click to Grow Your Business”. The NEO Card feature will provide access and financial services to more than 65 million SMEs in Indonesia, and the productive sector. others such as freelancers, and digital content creators for business development and help drive prosperity to the next generation.

During the Covid-19 pandemic, the demand for KoinWorks services soared as more and more businesses had to find digital solutions to survive. After securing $108 million (approximately IDR 1.6 trillion) of Series C funding, KoinWorks is uniquely positioned as the only inclusive one-stop-shop solution for SMEs in Indonesia. Supported by Mastercard and BNI, and a network of trusted partners, KoinWorks launched a new product to overcome barriers to financial access to millions of SMEs in Indonesia through the experience of using a complete and comprehensive integrated financial service.

“Digital SMEs represent our country’s biggest asset, but conventional financial institutions do not yet understand the characteristics or meet their growing business needs,” said KoinWorks CEO & Co-founder Benedicto Haryono. “With KoinWorks NEO and NEO Card as key features, SMBs finally have a comprehensive platform to scale and grow their business, with access to all the tools they need to advertise, buy products, transact online, and more.”

Creating Economic Equity for the New Generation of SMEs

Despite being home to one of the largest and fastest-growing economies in the world, by 2021, only 6.1% of Indonesia’s population will have access to loans, and two-thirds of SMEs will have no access to financial services. The absence of tools and financial literacy, as well as access to credit, poses a significant barrier for entrepreneurs to improve and develop their businesses.

Located in one simple and easy-to-use application, KoinWorks NEO provides remittance services, payment link services to create payment links, monitor financial condition, and expense reports, and all the financial literacy assistance business owners need to grow their business. Users also have the opportunity to get attractive promos from merchants.

KoinWorks NEO has the following services:

- Financial management: Automatically combines financial activities and money movements. This service can also accept client payments of any method to KoinWorks NEO, with support from all payment providers.

- Quick and easy access to business loans: SMEs have access to a variety of loans for a variety of purposes, including installment loans, and earned wage access (EWA) for their employees, where business owners can get an upfront payment before the payment cycle.

- Virtual Card “NEO Card”: Functions as a prepaid and charge card supported by Mastercard and BNI to make online transactions easier through the Virtual Card Number (VCN) feature. In addition, the NEO Card can be used to process any local or international payment transfers for free.

In celebrating the release of KoinWorks NEO as a transformative financial solution, Navin Jain, Country Manager of Mastercard Indonesia shared his opinion on the NEO Card, “Mastercard is delighted to be collaborating with KoinWorks and BNI to launch the NEO Card, an innovative payment product that gives business owners access to finance. banking tools and services in order to make online transactions safely and conveniently. Products like the NEO Card create financial inclusion in the entrepreneurial community, which helps expand the government’s commitment to increasing financial and digital inclusion in Indonesia.”

In line with Mastercard, BNI expressed its support and hope for this collaboration. “BNI conveys its support for this collaboration as one of BNI’s innovations to encourage transactional activities through the KoinWorks application. BNI believes that the collaboration with KoinWorks in the form of using a Virtual Card Number (VCN) will be a breakthrough for transactional needs for KoinWorks users. In addition to increasing financial inclusion, this innovation is expected to help promote economic equity and digital transformation in the future,” said Corina Leyla Karnalies, Director of BNI’s Consumer Business.

Along with the launch of KoinWorks NEO, KoinWorks officially started KoinWorks NEO Inspire, a story pitch competition which is also KoinWorks’ latest step in its contribution to SMEs. KoinWorks NEO invites participants from six categories: SMEs, women entrepreneurs, content creators/influencers, startup companies, freelancers, and teachers. Each category of participants will go through a series of selections until they are selected to join a boot camp with mentors and then advance to the final round. KoinWorks prepared prizes with a total value of 2 billion rupiahs for all winners at the end of the competition.

To join the millions of people who are already using KoinWorks, download the KoinWorks app and activate your KoinWorks NEO account in minutes. SME players and potential participants of KoinWorks NEO Inspire can register through koinworks.com/neo