Dapatkan pendanaan modal usaha hingga 2 miliar dengan tenor fleksibel 6 – 24 bulan, suku bunga flat dengan biaya yang transparan, pinjaman tanpa agunan, mudah dalam pengajuan dan pencairan.

Pelajari 7 tanda bahwa bisnis Anda membutuhkan modal tambahan untuk berkembang.

KoinBisnis merupakan produk pinjaman modal usaha yang ditujukan untuk pengembangan bisnis dan pemberdayaan UMKM di Indonesia yang telah terdaftar dan diawasi oleh Otoritas Jasa Keuangan (OJK).

Anda bisa mendapatkan akses pinjaman untuk pengembangan usaha sampai dengan Rp2 miliar.

Dapatkan pinjaman modal usaha dengan mudah, cepat dan tanpa agunan.

Dapatkan akses pendanaan hingga Rp 2 miliar untuk segala kebutuhan pengembangan bisnis Anda.

Proses pengajuannya mudah dan cepat melalui satu aplikasi KoinWorks.

Interest is competitive, transparent, and with no hidden fees.

Berbagai alasan meminjam di KoinBisnis yang pasti membuat Anda aman dan nyaman

KoinWorks juga terdaftar sebagai penyelenggara Inovasi Keuangan Digital (IKD).

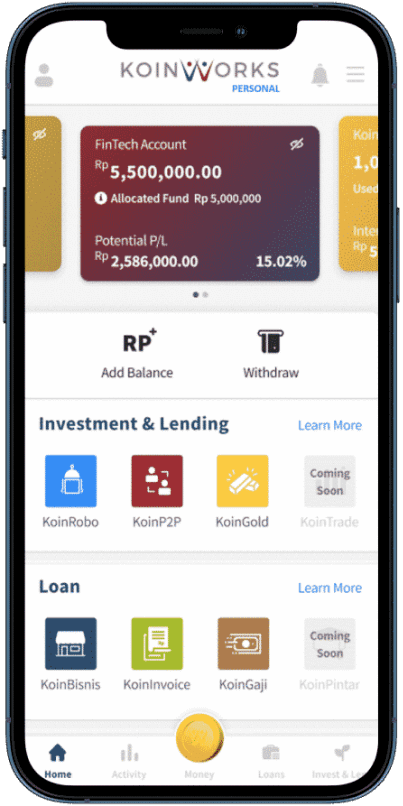

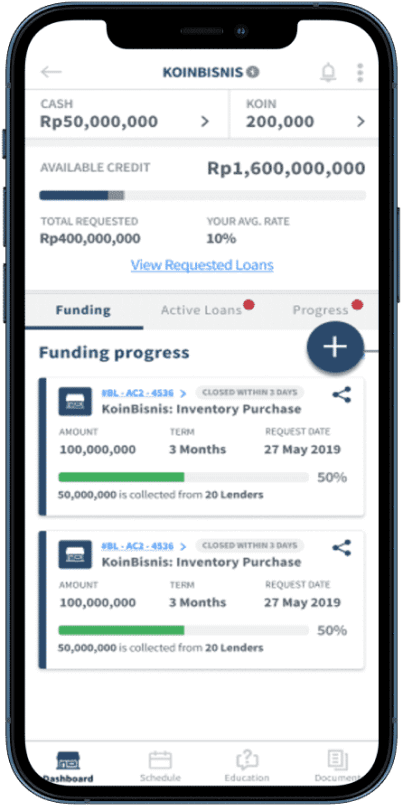

Rekening Bisnis, Transfer Uang, Investasi semua dalam satu aplikasi

KoinWorks telah memiliki sertifikasi ISO 27001. Semua transaksi dijamin aman dengan sistem keamanan yang canggih dan handal

Sesuaikan aplikasi Anda untuk #WujudkanImpianAnda segera.

Coba sekarang dan dapatkan manfaatnya secara instan

Instal aplikasi KoinWorks dan daftarkan diri kamu sebagai Akun Bisnis

Pilih menu KoinBisnis dan lengkapi data untuk memulai pengajuan pinjaman kamu

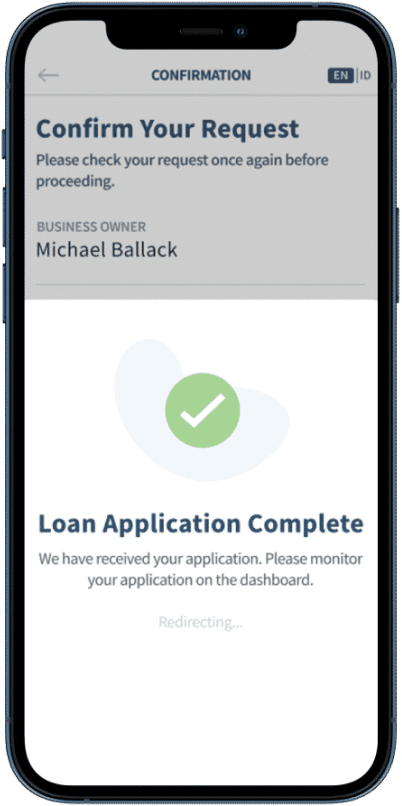

Setelah melengkapi data, kamu bisa mulai ajukan pinjaman untuk bisnis kamu

Setelah disetujui, pengajuan pinjaman kamu akan tampil di daftar pendanaan KoinBisnis

Setelah terkumpul pendanaan, kami akan mengirimkannya langsung ke rekening kamu

Proses yang mudah dan transparan bagi Anda untuk #WujudkanMimpiAnda.

Peminjam mengajukan pinjaman secara online melalui aplikasi

KoinWorks menganalisa semua data dan memberikan skor kredit A - E

Pengajuan pinjaman yang disetujui akan ditampilkan di daftar pendanaan KoinBisnis

Ratusan ribu Pendana menganalisa pinjaman dan mendanainya

Pinjaman yang telah didanai minimal 80% dan telah dicairkan ke rekening Peminjam

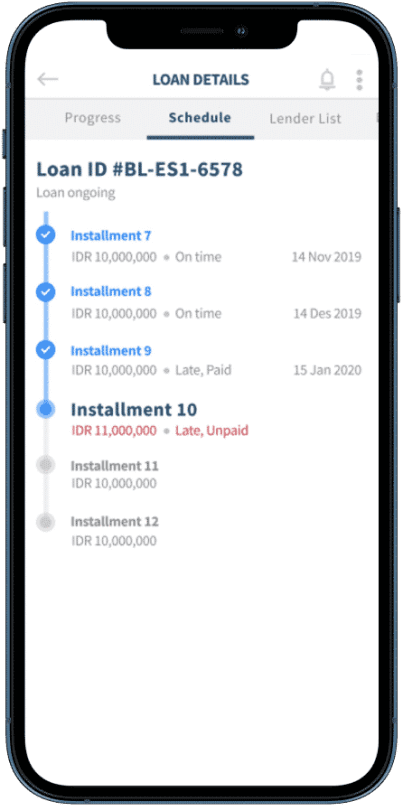

Peminjam dapat memanfaatkan pinjaman modal usaha dan membayar cicilan sesuai dengan tenor

Sistem KoinWorks secara otomatis mendistribusikan imbal hasil kepada Pendana berdasarkan porsi pendanaan masing-masing Pendana (Pokok + Bunga)

Semua biaya bersifat transparan, selamat tinggal biaya tersembunyi!

Bunga/bulan

Biaya persetujuan kredit

Asuransi Jiwa

Biaya administrasi

KoinBisnis adalah produk pinjaman yang ditujukan untuk pengembangan bisnis dan pemberdayaan UMKM. Dapatkan pendanaan modal usaha hingga 2 miliar, bunga rendah, tanpa agunan dan pengajuan yang mudah melalui aplikasi.

Alasan memilih KoinBisnis:

Tidak, persyaratannya sangat mudah untuk proses pengajuan pinjaman modal usaha KoinBisnis. Anda hanya perlu menyiapkan dokumen-dokumen berikut ini:

Untuk Bisnis Rumahan:

Untuk Perusahaan:

Ikuti langkah-langkah berikut ini untuk mengajukan pinjaman modal usaha KoinBisnis: