As a lender in P2P Lending, you have an obligation to participate in the reporting and payment process as an Individual Taxpayer in the form of interest income tax.

You can submit this tax report no later than March 31st.

Follow these steps to file your taxes.

Daftar Isi

Things to Prepare before Reporting SPT

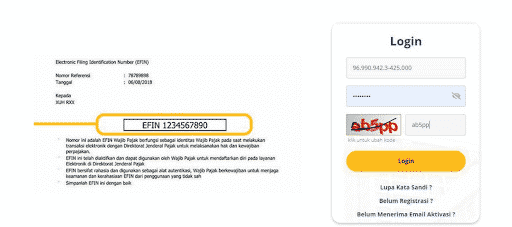

- Set up EFIN or DJP Online password

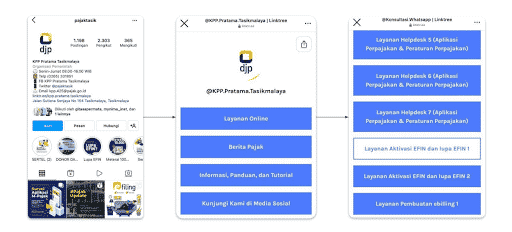

- If you don’t have one, submit an EFIN application via:

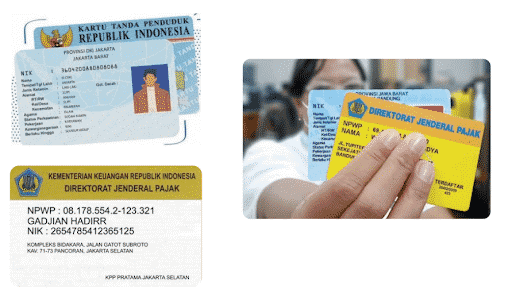

- Prepare another important documents such as KTP (ID Card) and NPWP (Tax Number).

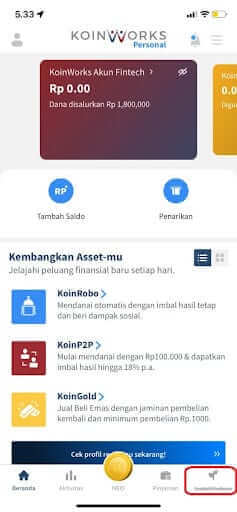

Download Tax Report in KoinWorks App

- Choose “Invest & Lend”

- Click “Portfolio” then scroll down until the bottom page

3. Make sure the year column is filled with “2021”. Click “Download” to get your tax report.

How to Report P2P Lending Taxes

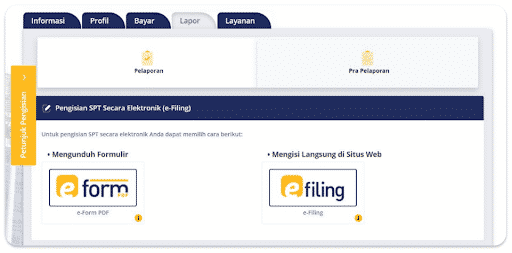

- Visit account.pajak.go.id/lapor;

*You can choose to report with e-form/e-filing

*The following example is using e-filling

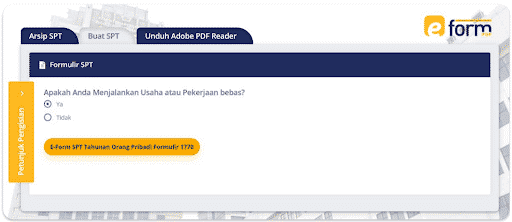

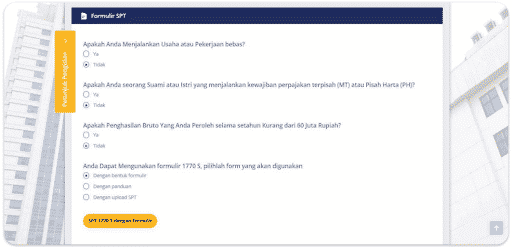

- Click “Create SPT”

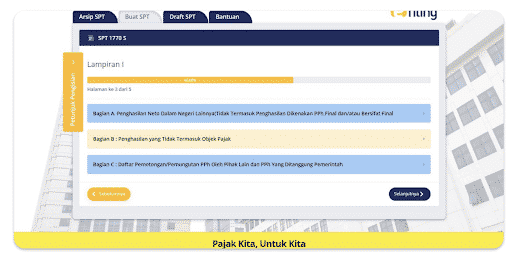

- Follow the given instructions including those in the form of questions. Fill in the SPT 1770S e-form following the existing guidelines, starting from Form Data, Attachment I, to Appendix II

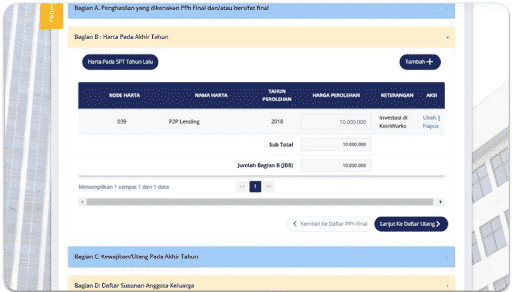

- For P2P Lending Tax, enter your P2P net income information in the Attachment II Part B (Year-End Asset) column by clicking “Add” and enter Asset Code 039. Asset Name and Description to be filled with KoinWorks P2P Lending/P2P Lending and “Acquisition Price” to be filled in according to the value of your capital as of December 31, 2021.

Download it here and use table 1 (Account/Account Statement), copy the numbers in the “account balance” column then paste/paste it in the “Acquisition Price” column

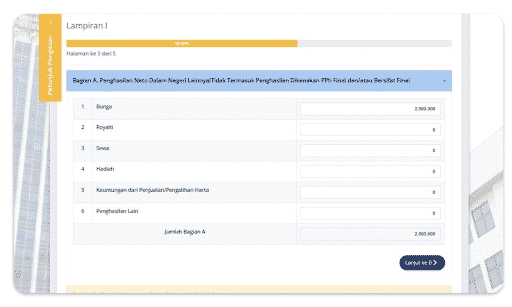

- For interest income that has been received during funding at KoinP2P KoinWorks, you can fill in the interest income information in Appendix I Part A No. 1

- Interest is filled in according to the value of your account as of December 31, 2021. Download here and use table 2, in the “Revenue in 2021” copy the numbers in the “Total Income” section into the “Interest” column

- Automatic calculation will be made to calculate the underpayment arising from the interest income you have received.

Next, you can make a payment for the underpayment. Follow these steps:

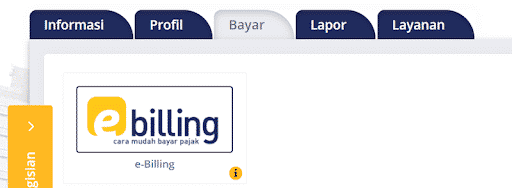

- Login to https://sse3.pajak.go.id site (if you have never registered or registered for e-billing) or click e-billing on the https://djponline.pajak.go.id site if you have already done so registration or e-billing registration

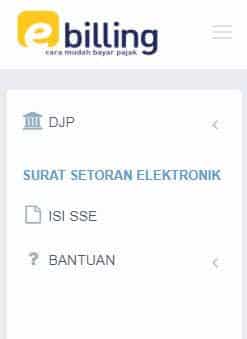

- Click “Isi SSE” menu that you can find on the left part of the page

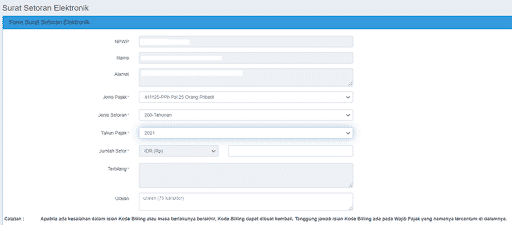

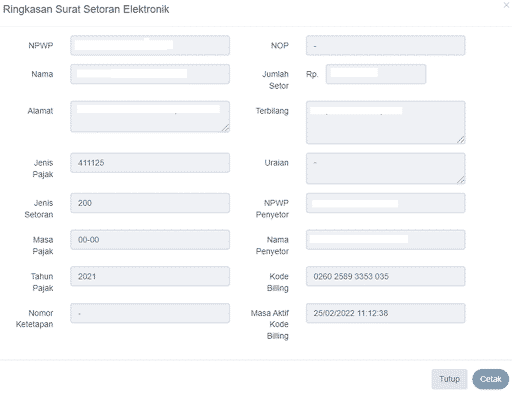

- Complete SSE by selecting “Type of Tax: 411125-PPh Article 25/29 OP, Type of deposit: 200-Annual, Fiscal Year: 2021”, then fill in the deposit amount according to the nominal underpayment

- If the data entered is correct, click the “Create Billing Code” button

- Click “Print” button to save the billing code

- Make a payment using the billing code you received. You can make payments through several banks. Please adjust to the bank you have.

Contact KoinWorks customer service if you encounter problems in reporting SPT via WhatsApp at number: 081703972888.