You will either receive the repayment monthly or lump sum (at the end of the tenor).

Available cash can be cashed out whenever it’s ready via the lender dashboard.

After you apply for withdrawal, we are going to transfer the fund directly to your bank account.

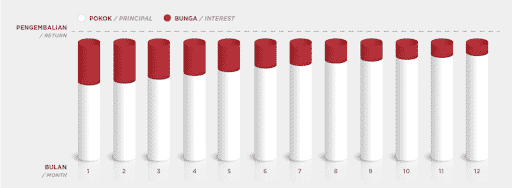

Installment

For loans that use the installment method, lenders will receive capital repayment and interest every single month until the end of the tenure.

For example: if a loan has 12 months tenure, lenders will receive 12 times of repayment.

Loan products with the monthly repayment method only have two due dates, namely the 1st or 15th of each month.

If the loan is disbursed on the 1st – 15th, then the maturity date on the 1st starts from the following month.

If the loan is disbursed on the 16th – 31st, it will mature on the 15th starting from the following month.

Interest for loans with monthly repayments is calculated monthly even if the borrower makes payments before maturity.

*For late fee regarding late payment, you can read more here.

Here is the simulation:

For installment loans, KoinWorks applies a 1% service fee for capital repayment, interest, and late fee (if any) every month of repayment.

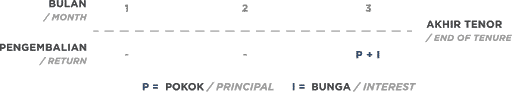

Lump-Sum

Lenders will receive the repayment only one time at the end of tenure.

For example: if a loan has 3 months of tenure, the lender will get one-time repayment at the end of the third month (100% capital + interest).

Interest for loans with Lump Sum returns is calculated daily from the disbursement of the loan until the borrower makes payments.

Please note that there is a processing time for funds to be received by the lender maximum of 3 (three) working days calculated from the payment from the borrower.

For example:

If the initial tenor is 3 months (90 days) but paid by the borrower 80 days after the loan is disbursed, and the funds are received by the lender on the 81st day.

The interest that will be received is the same as the interest paid by the borrower, which is the amount of interest for 80 days.

KoinWorks applies a 5% service fee for lump-sum loan methods only for the interest.

Here is the simulation:

Setiap produk pinjaman lump sum akan diberikan label Lump sum pada bagian Jenis Pembayaran di dalam detail produk.

Loan With Grace Period

Lenders will only receive the interest as the repayment during the grace period.

After the grace period ends, lenders will finally receive the capital (and the remaining of interest) which has been accumulated from the grace period.

For example: a loan that has 12 months of tenure with 6 months of grace period, in the first month until the six month lenders will only receive interest as the repayment.

Then 6 months remaining, lenders will still receive the interest plus the capital which is total capital divided by the remaining months, which is 6 months (not 12).

Service fee for grace period loan is the same as installment, 1% from capital, interest and late fee (if applicable).

During the grace period, KoinWorks only deduct 1% from the interest.

Here is the simulation:

![]()