More than just a financial platform, we deliver healthy financial return with significant impact

“We look at our biggest dream (for now, that is), which is to create a circular cycle of investing where everyone in the digital ecosystem benefits from each interaction they undertake. Small impact investments can bring the dreams of MSMEs to life and affect a lasting positive change in the lives of the businesses and communities they serve. And throughout, individual investors can help make these dreams happen while achieving their own financial goals. Everyone wins in this scenario — in this dream that we now all share ”

Benedicto Haryono

Co-Founder and CEO of KoinWorks“As we advocate for an inclusive digital business ecosystem, we look to the future with sustainability as our next major initiative. This is the way to positively impact the growth of Micro, Small and Medium Enterprises (MSMEs) and, in turn, these efforts will reverberate throughout the country’s economy through job creation and uplifted communities.”

Willy Arifin

Commissioner Executive Chairman & Co-Founder of KoinWorks“Showcasing accountable impact metrics is our top priority. With the proper metrics, not only should we be able to see how 64 million MSMEs contribute to the development of the middle class in Indonesia, in numbers and narrative, but we also should be able to assess their value as a whole.”

Angelique Timmer

Senior VP Impact & ESG2.2 Million Users Have joined KoinWorks to unlock their dreams, spread across 34 of 37 Provinces in Indonesia.

IDR 15 Trillion (USD 1.1 Billion) have been disbursed to solve MSMEs liquidity constraints.

In July 2022, our investor AC Ventures together with the Boston Consulting Group of Indonesia assess that our overall ESG net-impact is a positive contribution of +63% Net Impact to Indonesia.

Our key impact drivers are the number of employment created; along with enabling digital access to finance and financial knowledge; and increasing user revenue and asset growth. Our net impact score is significant. It is 2 times of BCA’s, 3 times of Mastercard’s, and 5 times of Goldman Sach’s.

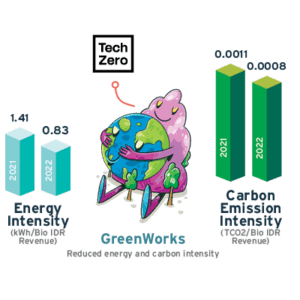

Aligned with the global ambition to reach carbon neutral, Koinworks adopted the Tech Zero framework, a leading guideline for tech companies joining climate action. We are actively reducing energy consumption and water use, producing less waste and carbon footprints within our ecosystem. With the total tonnes of emissions increasing while expanding our business, we are consciously being more efficient with the intensity, the number of energy used (kWh) and carbon emissions (TCO2) per revenue (Billion IDR)

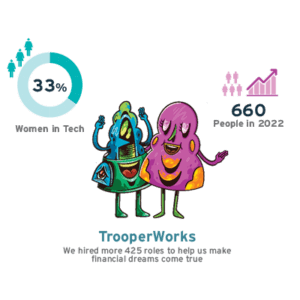

We uphold the ESG principles to our Troopers (this is how we call our employees) in all leadership roles and people matters. Our ESG integration in talent management has attracted highly-sought after talent with high ethical standards, who value every step of their journey with us in delivering a positive impact.

KoinWorks takes care of all aspects matter in creating MSMEs inclusive growth.

As a digital platform, our most significant contribution to society is to unlock the barriers of underserved businesses to get ACCESS to funding.

It has been our commitment to upskill our MSMEs and individual investors with business and financial literacy initiatives.

After disbursement, Koinworks users have better business performance, entrepreneurial skills and confidence compared to the non-KoinWorks, leading to an exceptional value created for Indonesian society.

In developing our products, we make sure that everything we offer will answer our users best interest. Not only delivering high quality product features but also we make sure the transparency of our product labelling.

Not only their business, but KoinWorks also improves many aspects of users’ quality of life.

KoinWorks support the digitization of MSMEs to streamline their business. With the launch of KoinWorks NEO in 2022, we further strengthened the digital support for our MSMEs and created access to digital payments & virtual cards services.

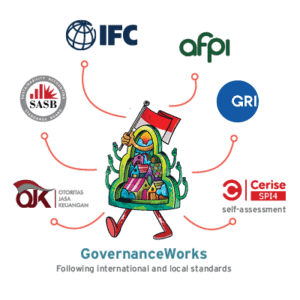

We uphold a high standard of corporate governance at all levels of our business in an effort to generate long-term value for our stakeholders. Our governance framework and management procedures enable us with the necessary foundation to do business responsibly, adhere to pertinent local laws and regulations, and maintain best practices standards of user privacy and data security in order to foster ecosystem trust.

We're on a mission to increase access to quality financial services for underserved consumers and MSMEs in emerging markets through our investments.

Since Quona invested in 2019, KoinWorks has made significant strides in deepening their impact on customers through customer education and expanded products (including NEO) that help SMEs get access to not only credit, but also digital transactions and payments.

"Our original impact thesis for KoinWorks centered on the company's potential to address the massive SME funding gap in Indonesia through its seamless, digitized process and focus on micro and small enterprises. KoinWorks is able to offer more than any other fintech SME bank or lender, in addition to offering more holistic accounts, payments, and card services, aiming to provide the SMEs a more superior banking experience.

They have also dedicated significant energy and effort behind educating the customers, which is essentially for responsible banking in the new age."

At MDI ventures we believe that investing in ESG and impact-focused companies will deliver the same if not more return compared with commercial Venture Capital investments in general. Implementing ESG helps companies to grow more sustainably and manage their risks better, and those 2 points are actually becoming more important since investors nowadays look deeper into Units of economics and healthy growth companies.

"KoinWorks has brought more equal opportunity, increased financial inclusion, and unlocked what was previously difficult to achieve with conventional financial institutions for all Indonesians, especially in the MSME sector. KoinWorks has shown strong growth and improvement, the ability to adapt to the challenges and needs of the market, and providing the best solution for Indonesia's financial gap issue

East Ventures believes in investing in the next generation with heavy focus on startups that put emphasis on how to make the world a better place for our children

We believe that every young person should have the opportunity to pursue their dreams and contribute to society.

"KoinWorks is well placed to provide diverse financial services and contribute to financial inclusion, while improving the financial literacy of millions of underserved customers in the country. Kolnworks paves the way to an inclusive society by enabling wider communities access to financial services."

Triodos invests in companies that contribute to a green, inclusive and resilient economy. Kolnworks exemplifies this through its core business of providing responsible, high impact digital financial products and services, combined with a strong commitment to managing social and environmental performance.

"We appreciate that KoinWorks serves the real economy and contributes to the SME segment, which is the backbone of the economy. As it remains innovative and well-attuned to its target group offering a variety of relevant services: supporting entrepreneurs with diversified financial products and enabling wealth management for retail investors. Triodos supports the ambition of Koinworks to position itself as a sustainable and impactful partner in growing business."

Financial inclusion has been integral to Saison International's philosophy and approach to value creation ever since its inception. Saison International as a financial group aspires to stand by customers during life events and corporate cycles, by providing access to a wide range of financial services and achieve customer As an impact investor, we aim to support d t companies that have proven traction of delivering affordable and accessible solutions and scale financial inclusion. success by combining the real and the digital.

"By facilitating access to financial services and working capital for underserved MSMEs in Indonesia, Koinworks contributes significantly to MSMEs' growth and economic opportunities. The "tech and touch" approach, Le, the use of innovation and digital distribution channels to successfully, and seamlessly reach out to thousands of underserved SMEs, combined with physical visits, makes KoinWorks unique in the Indonesian market."

"Investing in technology-driven, high-growth startups, AC Ventures catalyzes positive impact and transformation in Indonesia, fueled by the belief that entrepreneurs hold the key to meaningful and lasting change. With a positive 63% net impact score, KoinWorks exemplifies our commitment to inclusive and accessible financial services for MSMES."