Easy

At KoinWorks you can start joining Lenders with a fast process. Register through the KoinWorks application, fill in your data. Next, verify your cellphone number via the OTP code sent to your cellphone. To comply with OJK rules, before you can fund, you are required to verify data. Don’t worry, your funds are safe with KoinWorks and will not be shared with anyone without your consent.

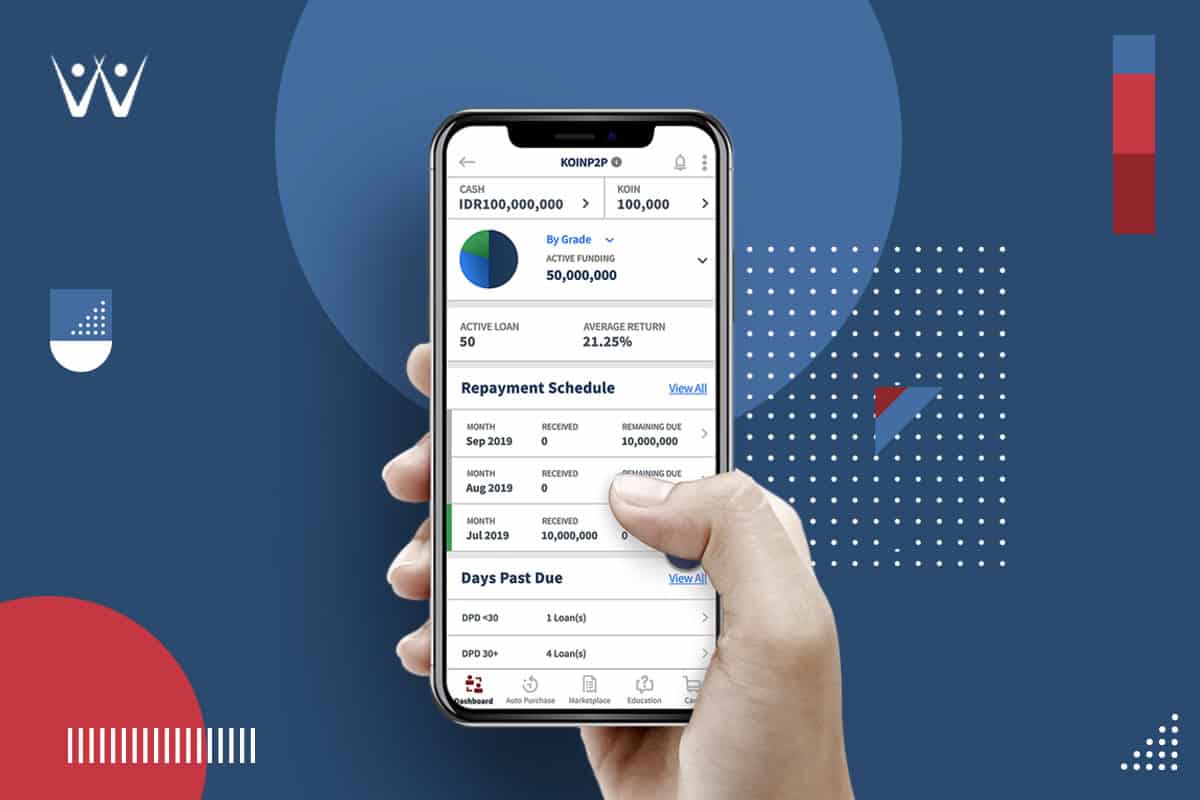

Start funding from IDR 100,000

Everyone can start funding in KoinWorks starting from IDR100,000. You can start funding a variety of Borrowing needs for productive purposes such as business or education development needs.

Secure with Provision Fund

KoinWorks uses a variety of strict measures to avoid the potential for default on the borrower, thus jeopardizing funds from lenders.

One of them, selecting borrowers using data from partners who have collaborated with KoinWorks, such as Lazada, Tokopedia, Shopee, Zilingo, and others.

With a rigorous and proven selection process, KoinWorks is the only fin-tech lending company that provides protection funds to guarantee lenders. The Provision Fund is dedicated by KoinWorks as compensation for the risk received by the Lenders in the event of a default from the Borrower.

In mitigating risk for lenders, KoinWorks believes that diversifying funding into several loans at the same time with various grades and types of loans is the best method of channeling funding on the KoinWorks platform.

The following is information about the protection fund that will be obtained by the funder, according to the grade of each funding.

The Purpose of Social Funding

In addition to being able to benefit from funding, you also help to realize the dreams of borrowers at KoinWorks in various fields, such as business and education.

Easy to Diversify

In KoinWorks you can easily arrange your portfolio. Determine potential borrowers from various needs. Also, you can diversify your investment funds easily because there are many borrowers with each type of need that is ready to be funded.

High return

You can directly fund the loan as you wish, then the borrower will pay you monthly. You can receive the return starting from 18%. This return certainly higher than conventional financial institutions in general.