The compounding effect is undeniably the best companion and blessing for every investor.

Every investor, especially those explicitly investing for the long term, will know how the compounding effect will significantly benefit their financial condition and goals.

So, what exactly is the compounding effect?

It is the reason why investors love it so much, and it often helps them realize their financial goals in the long run.

Let’s find out more!

Daftar Isi

What Is the Compounding Effect?

Simply put, the compounding effect is the ability of an asset to generate profits to be reinvested to generate profits again.

In other words, the compounding effect is an effect that generates income from previous income.

The compounding effect is also often referred to as ‘compound interest’ or ‘rolling interest,’ where the interest earned from a previous investment is reinvested into the same or a different instrument.

So, the interest that was invested earlier also generates interest again.

Or your income generates more income. And so on until the return on investment is maximized.

To put it in detail:

- Interest from compounding results can be obtained when the money you make from investment generates profits again when reinvested.

- The compounding effect is arguably one of the easiest ways to meet financial goals.

- The earlier you invest, the more opportunities you have for your investment to enjoy the compounding effect.

Many still need to learn that the compounding effect is very beneficial. To start funding, people tend to say that they can’t afford to save money to invest. Money is not the problem because, in this case, time is the most important thing.

Investors often rely upon the compounding effect because of its significant impact on financial plans and goals over time.

Since the most important thing is time, everyone can experience the compounding effect if they are ready to start investing in the early stage.

The earlier one starts funding, the stronger the compounding effect on their investment returns.

What are the Benefits of the Compounding Effect on Investments?

Perhaps many people are still reluctant to start funding because they think investment is only for those already established.

Investments are often made to get to ‘stability.’ Investing requires a large amount of initial capital and risks. Risks can be mitigated relatively quickly, and the costs are not significant.

With as little as IDR100,000, one can become a lender or investor. Several alternatives, such as investing in mutual funds (reksadana) or stocks, can be used.

In addition, you can also do it on KoinP2P funding or peer-to-peer lending from KoinWorks while learning investment fundamentals and getting returns starting from 18% per year. It is a far-fetched excuse if people still think that funding activities are expensive.

Most people prefer to subscribe to entertainment services such as streaming music or streaming films online; many even subscribe to both simultaneously. In fact, if accumulated into an investment fund, each person can invest IDR300,000 every month.

Let’s say you are 21, subscribe to an entertainment service, and regularly spend IDR300,000 monthly for the next 40 years.

At the age of 61, the total money you have spent is IDR144,300,000 (excluding inflation, value addition, and so on). In fact, at the age of 61, you should have prepared a retirement fund.

If that IDR144,300,000 is allocated as an addition to your investment fund, then you can enjoy your retirement well.

You spent IDR144,300,000 on things that seem trivial but, when accumulated, will have a very significant effect on future finances.

Although the IDR144,300,000 does not include the effects of compounding and inflation, at least you know the picture of how much influence the total accumulation of funds that have looked trivial to you over time.

If invested, the funds you spend every month are enough to support your life in the future.

Various investment instruments offer significant returns. For example, the highest interest rate (coupon) of retail bonds (ORI) from the government can reach 12.05%, and the lowest value is 6.25%. That means, on average, an ORI investment can generate 6% interest profit. Not to mention Retail Sukuk, where the average return is above 7%.

On the other hand, stock profit interest, according to IDX data, can reach 15% and 24% (from the last ten years of data).

For funding at KoinP2P, the compelling profit interest averages 18% per year, with a maximum of 21.32%.

That means, from your total funding that is actively done at KoinWorks, you can enjoy 18% profit interest in one year if you continue to fund actively.

If we simulate how the compounding effect will be very beneficial when investing IDR300,000 as investment capital, then approximately the following benefits.

Simulating the Benefits of Compounding Effect on Investment

Let’s use the example of KoinWorks P2P Lending‘s effective interest rate of 19% from the maximum interest rate of 21.32%.

If you currently have IDR300,000 and can re-allocate IDR300,000 monthly to increase your funds, how much money can you get in the next five years?

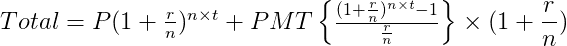

We use a calculation formula as shown below:

Where:

A = future value of investment, including interest

FV = Future value / future value with additions

P = Initial/principal investment

PMT = additional monthly investment

r = interest rate per year (in decimal form)

n = frequency of compounding effect in a year (for example: if it occurs monthly, it means that during the year, it occurs 12 times) and also the frequency of additional investment (for example: if additional investment occurs monthly, then in a year there are 12 additions)

t = time (year)

So, if we categorize them one by one, then:

P = IDR300,000

PMT = IDR300,000

r = 19% => 19/100 => 0,19

n = 12

t = 5 years

To calculate the total funds you allocate to KoinWorks in the next five years, the formula we use is Total = A + FV, and then we have to find A and FV first.

Calculate automatically by using the calculator below:

From the results above, if you regularly allocate IDR300,000 to fund each month, then:

- Total Money Funded: IDR 18,300,000

- Interest Earned: IDR12,621,681

- Future value (including compounding effect): IDR30,921,681

So, from the total of IDR18,300,000 you managed to allocate in 5 years, if you deposit IDR300,000 per month, with an interest rate of 19% per year, you managed to get a total interest of IDR12,621,681, which means the total value of your money in the next five years will be:

Total: IDR18,300,000 + IDR12,621,681 = IDR30,921,681

Instead of using your money for unproductive things and leaving it in your savings account, where it keeps decreasing due to inflation and administration fees, why not let it grow by 19% yearly?

That’s the great benefit of investing/funding and its compounding effect.

If you are reluctant to fund because you need more capital, you can start funding when you have IDR100,000 to allocate!

The compounding effect can be very beneficial for you with KoinWorks. Be patient and diligent in setting aside money to allocate every month.

Since the compounding effect prioritizes time rather than money, start investing early, starting from now.

Investment Strategy with Compounding Effect

1. Start as Early as Possible

As mentioned, the compounding effect will be more significant if utilized as early as possible. So, start now. Even if you have begun funding, continue.

Not only should you invest regularly, but you should also diversify your investment funds by allocating them to various investment instruments.

2. Invest at least every month

Investing just once will have little effect on your future financial situation. Routinely allocate a certain percentage of your monthly income to be invested in various instruments.

Remember, “Don’t put all your eggs in one basket,” and never allocate all your invested funds to one place!

If you have been investing in stocks, don’t just invest in one stock. Try other companies that might be more profitable.

If you’ve only invested in stocks or bonds, try other investment instruments like peer-to-peer lending, such as KoinWorks, or mutual funds.

3. Choose Investment Type According to Risk Tolerance

The type of investment must also be in accordance with your risk tolerance, which means it must be under the level of risk you can accept in the event of a loss.

Although often associated with stock investment, investing according to risk tolerance is also related to other types of investment.

When choosing what type of investment suits you, first learn about the advantages, disadvantages, and risks involved.

Does the risk match the potential profit you can receive later? If so, then target the compounding effect. Invest in it for the long term, starting now, without missing out on analyzing the risks and potential losses.

4. Create a Low Risk, High Return Portfolio

The terms “high risk, high return,” and vice versa are well known in investing.

So, how do you create an investment portfolio that is low risk but has the potential to generate higher investment returns, aka low risk, high return?

Utilizing the compounding effect, such a portfolio will generate maximum returns to your financial situation in the long run.

Good luck!