Before starting with how to use it, you need to know that there are two types of accounts that you can create in KoinWorks Super Financial App, namely:

- Personal Account

- Allows you to fund/asset development with peer to peer lending products (KoinP2P, KoinRobo), gold (KoinGold), and Government Securities/SBN (KoinBond).

- Allows you to get a loan for your personal needs with an advance salary product (KoinGaji) and a pindidikan loan (KoinPintar).

- Business Account

- Allows you to apply for loans for development and business with KoinBisnis and KoinInvoice products.

- Allows you to fund/asset development with peer to peer lending (KoinRobo) and gold (KoinGold) products.

You can also have these two accounts and use them in the same application with different e-mail.

So, you don’t need to make a clone or duplicate the application to create more than one KoinWorks account.

Daftar Isi

- How to Use KoinWorks App with Personal Account

- How to Use KoinWorks App with Business Account

How to Use KoinWorks App with Personal Account

Before registering, you must download your KoinWorks app in your gadget, then you will be able to register a new account.

1. Account Registration

- Open the KoinWorks App, choose “Personal Account”

- Start completing required data like the picture below:

- Enter 4 digits OTP code sent to your phone number. If there’s no message you received, click “Resend Code”

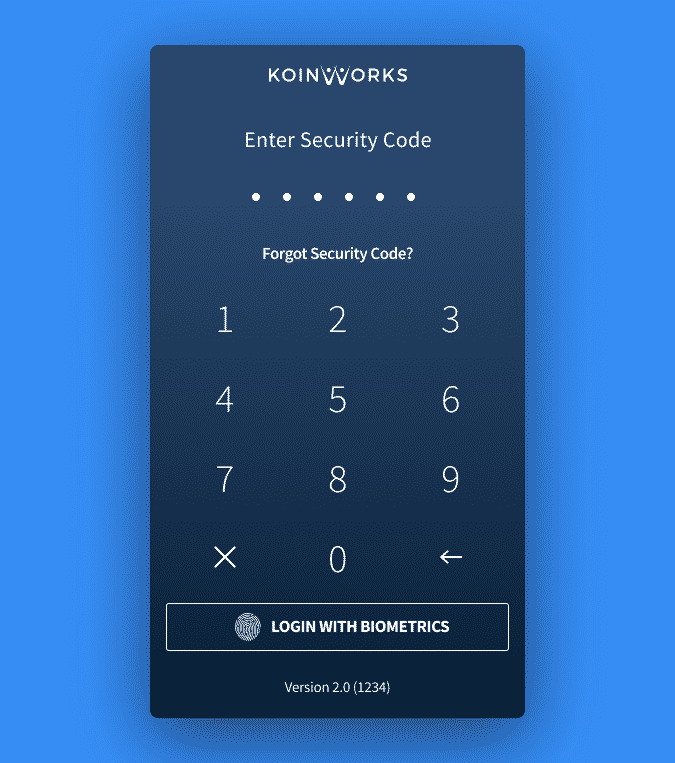

- Create and enter 6 digits security code which will be used to sign in to your account. You can also make security code using fingerprints (for supporting devices)

This is the dashboard which will appear if you have completed registering your new personal account. Don’t forget to check your e-mail to do final verification.

2. Sign in to Your Account

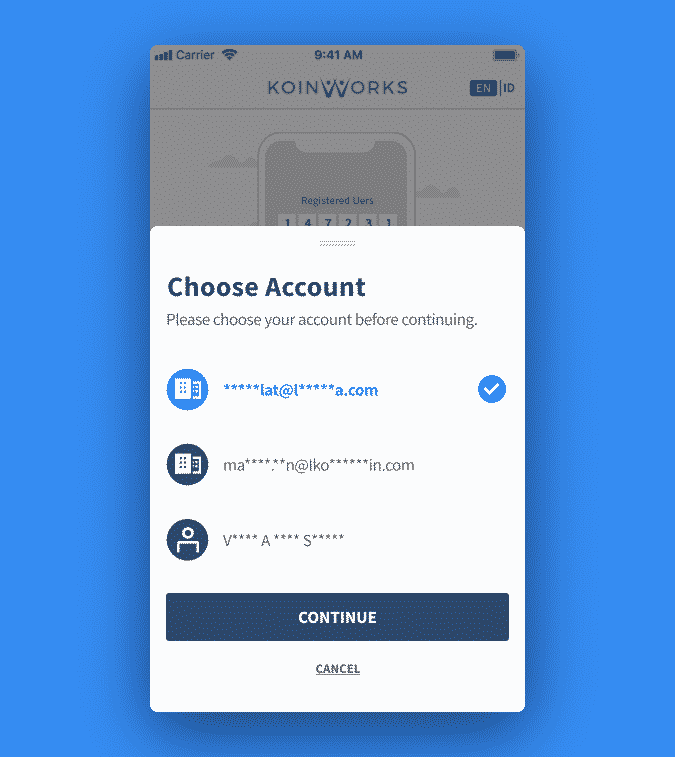

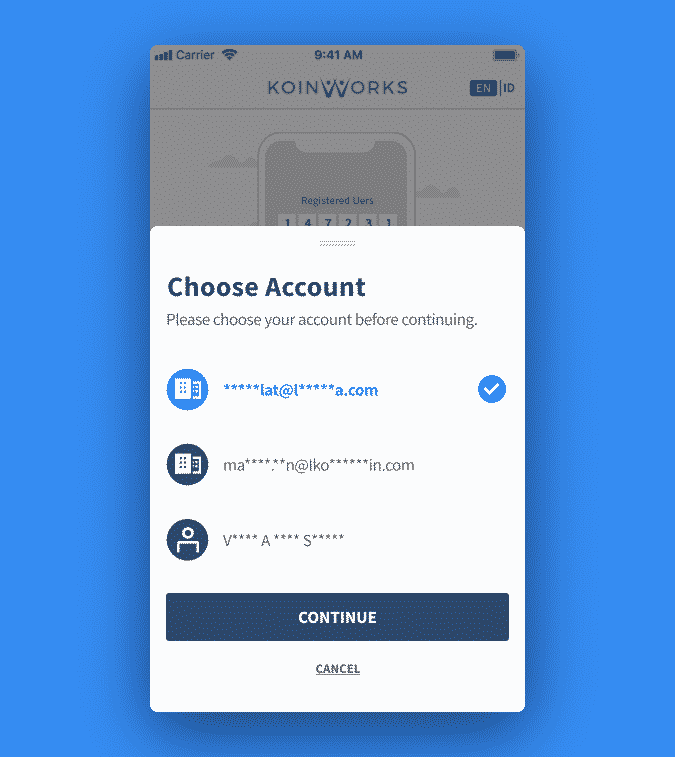

- If you only have one account, you can directly enter your e-mail adress or phone number you use to register. But if you have multiple accounts, click the personal account you wish to sign in to

- Enter the 4 digits OTP code which will be sent to your e-mail or phone number. Click “Resend Code” if you receive no message

- Enter 6 digits security code you created when you register. If you forget the code, you can click “Recover” to recreate new security code

- You have successfully signing in to your personal account and ready to make your first funding!

Note: To facilitate the log-in process, KoinWorks application provides a Stay Logged In feature, so you no longer need to enter your cellphone number or e-mail every time you want to sign in. You only need to enter a 6 digits Security Code or fingerprint to log into your account.

3. Choose KoinWorks Funding or Personal Loan Products

After successfully signing in and entering the “Dashboard” page, you can start choosing the funding product you want to fund, namely KoinP2P, KoinRobo, KoinBond, and KoinGold, or apply for a personal loan, namely KoinGaji and KoinPintar.

Here’s the full explanation:

Funding Products

1. KoinP2P

KoinP2P is a KoinWorks P2P Lending funding product that allows people who own funds to connect with people who need funds on one platform and can be accessed online, anytime and anywhere.

As a lender, you can choose which loan you want to fund on the KoinP2P marketplace, and get return according to the tenor you choose.

For more information about KoinP2P, learn about in this KoinP2P guide article.

2. KoinRobo

KoinRobo is a KoinWorks P2P Lending funding product with predictable returns of up to 15% per year.

In KoinRobo, your portfolio will be automatically diversified with artificial intelligence technology.

For more details, you can read the KoinRobo guide before starting to fund.

3. KoinBond

KoinBond is a platform for buying Government Securities (SBN) issued and guaranteed by the government of the Republic of Indonesia.

Check out the full explanation of KoinBond here.

4. KoinGold

KoinGold is an efficient gold buying and selling platform because all transactions can be done online 24/7 through one application, the KoinWorks Super Financial App.

With a minimum of IDR 1,000, you can already buy gold at KoinGold, you know!

Check out more information about KoinGold here.

Loan Products

1. KoinGaji

KoinGaji is a salary advance service from KoinWorks that allows you to withdraw your salary in advance before your payday arrives.

To be able to use KoinGaji services, your company must first become a KoinWorks partner.

Check out the full explanation in this article.

2. KoinPintar

KoinPintar is an education loan service from KoinWorks that you can get to fund formal and non-formal education without collateral.

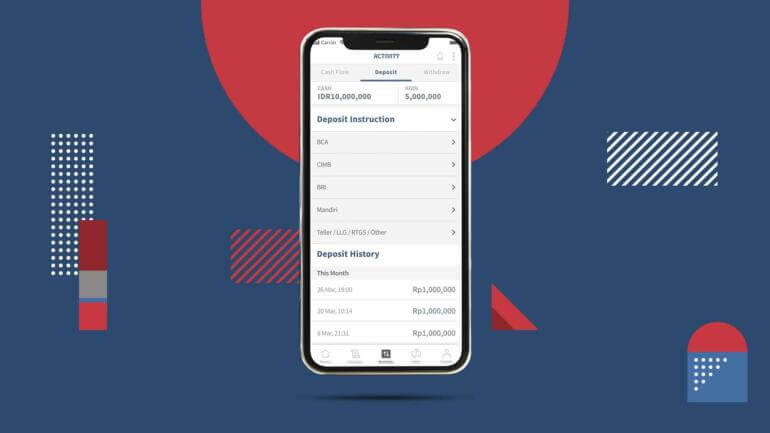

4. Make Fund Deposit

The first step you have to do before start your funding is making fund deposit to your KoinWorks account.

The minimum deposit is IDR 100,000 and applie multiply.

For more information about how to deposit to your KoinWorks account, click here.

5. Look for Available Funding

When you are going to fund, you should know in advance about the details of the available loans. Also know the type of loan, term, interest rate, and risk.

https://www.youtube.com/watch?v=04TYNfBq4sM

You can see the factsheet owned by the borrower (as the business owner) and analyze it more carefully. Starting from descriptions, financial information, SWOT analysis, business information, to examples of products being sold.

More details, you can learn about it in this article.

Well, in addition to looking at the available loans, you also need to calculate the estimated profit that you will get.

Watch the video below to find out the calculation!

More guidance, read here.

6. Checkout Your Funding

Like shopping for products in e-commerce, in KoinWorks application, you will also go through a checkout process.

In other words, you decide to buy a KoinWorks product that you have marked in your shopping cart, then you will be directed to the final payment.

Find out the complete KoinWorks guide on how to checkout here.

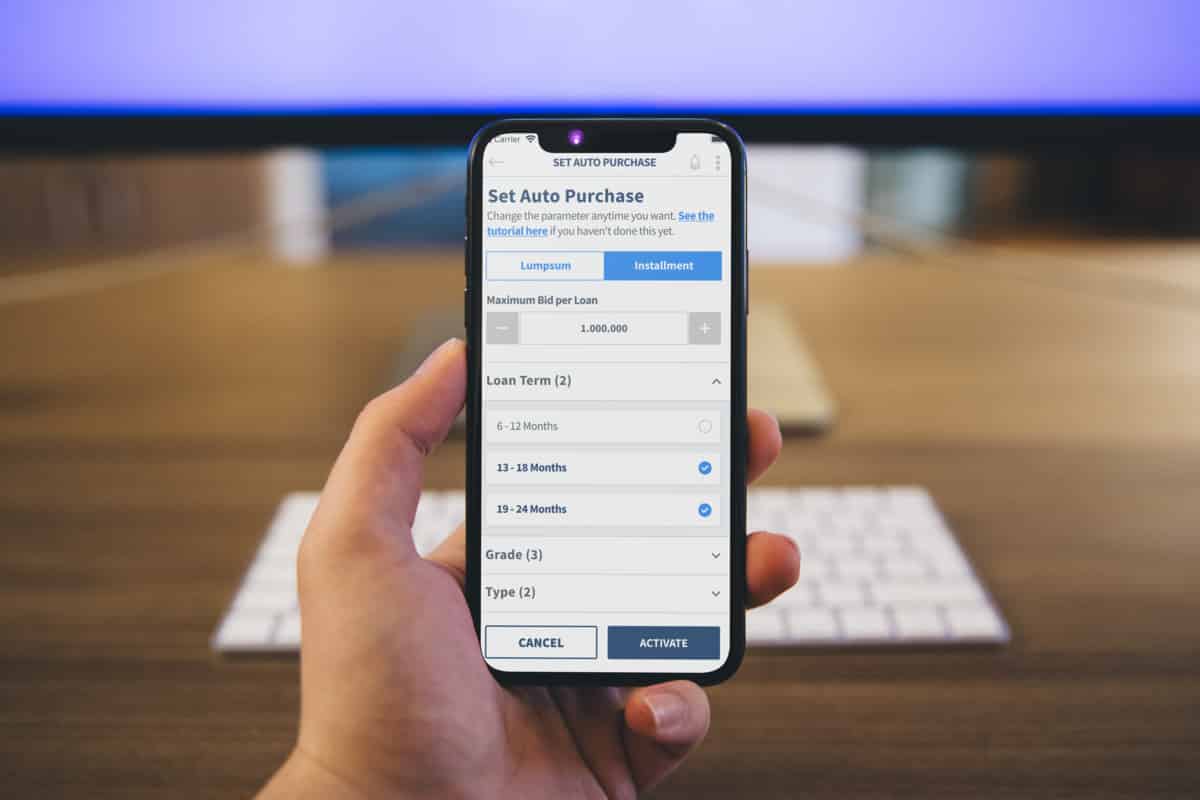

7. (Optional) Activate Auto Purchase Feature

Auto Purchase is a feature in the KoinP2P which can help you automatically diversify your funds with various parameters according to your needs, such as based on the type of loan, grade, tenor, loan objective, and repayment method (both installation and lump sum).

Let’s get to know the Auto Purchase feature more here.

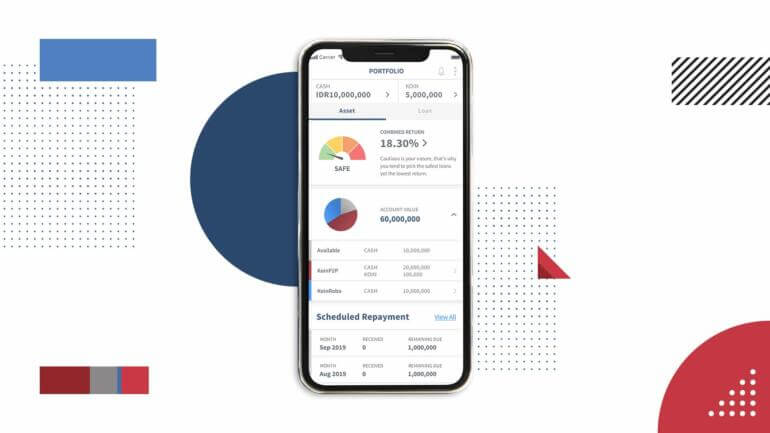

8. Check Your Portfolio

Complete details about each funding you make will be listed on the portfolio page.

In “Portfolio” menu in the KoinWorks application version 2.0 and above, you can see a loan summary, schedule and estimated loan repayments, to an explanation of all your funding status.

Portfolios are very important to know the progress of your funding and the estimated return you will get when you make your next funding.

Read a more complete guide on portfolios here!

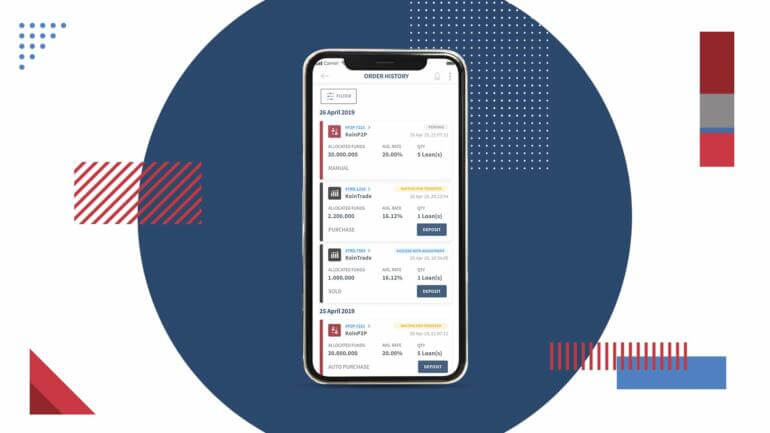

9. Order History

If you have started actively funding, you will see your funding history in the “Order History” menu in the KoinWorks application.

All data in the “Order History” page is displayed in detail, complete with the date of funding, value/nominal funding, and the amount of the loan you funded.

You can also cancel orders from your funding that have already been processed before your funding stage is complete.

Read the complete informations here.

10. Withdrawal

You can maximize your profits by taking advantage of the compounding effect, where you reinvest the interest you earn to earn more interest.

After you feel that there are enough numbers, you can withdraw your profits in a very easy way in the KoinWorks application.

You can disburse funds or withdraw these funds at any time and through an account that has collaborated with KoinWorks.

Want to know how? Let’s see the tutorial here.

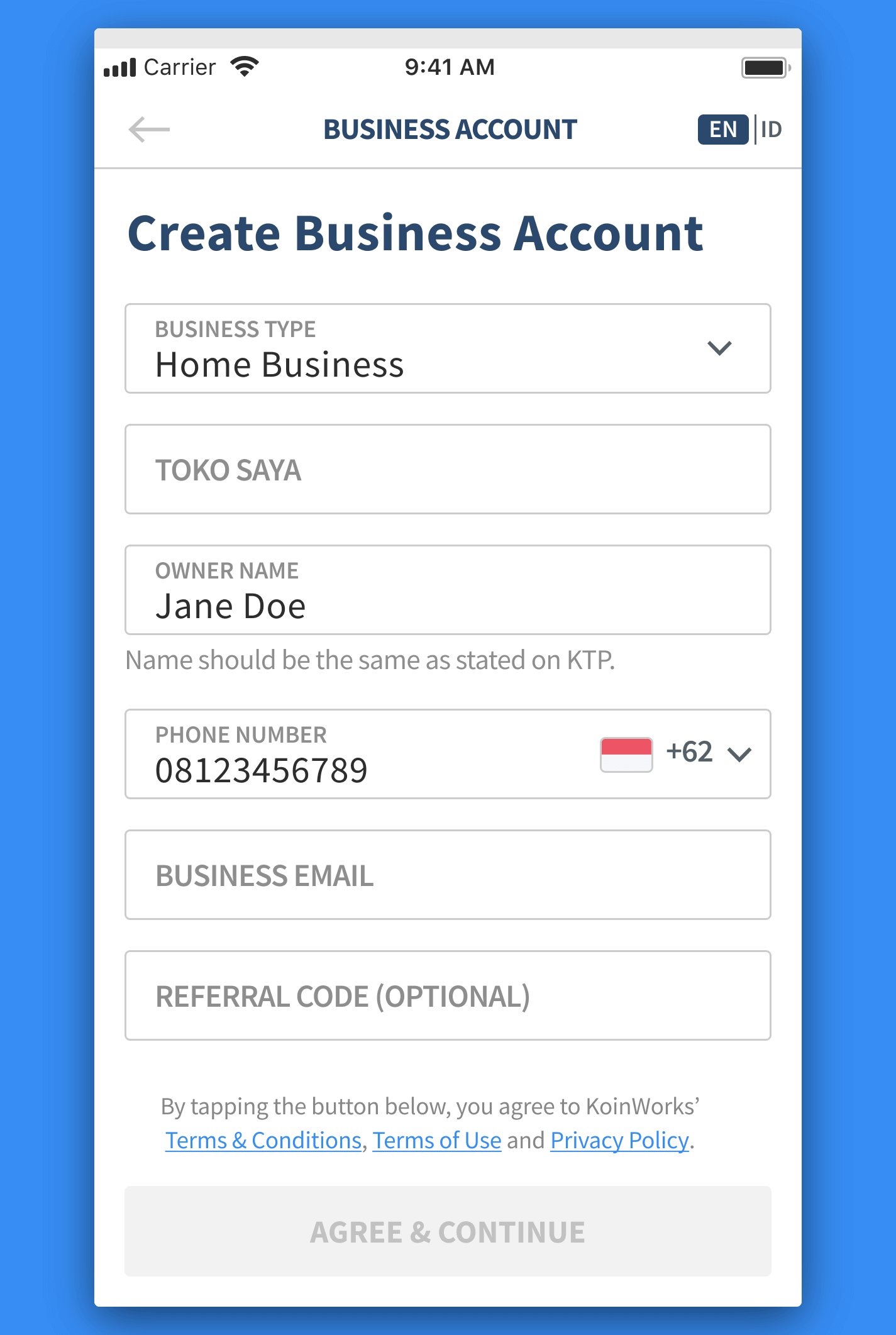

How to Use KoinWorks App with Business Account

1. Account Registration

- Open your KoinWorks app, choose “Business Account”

- Start registering by completing required data like the picture below:

- Enter 6 digits verification code sent to your e-mail. Click “Resend Code” if you don’t receive any message

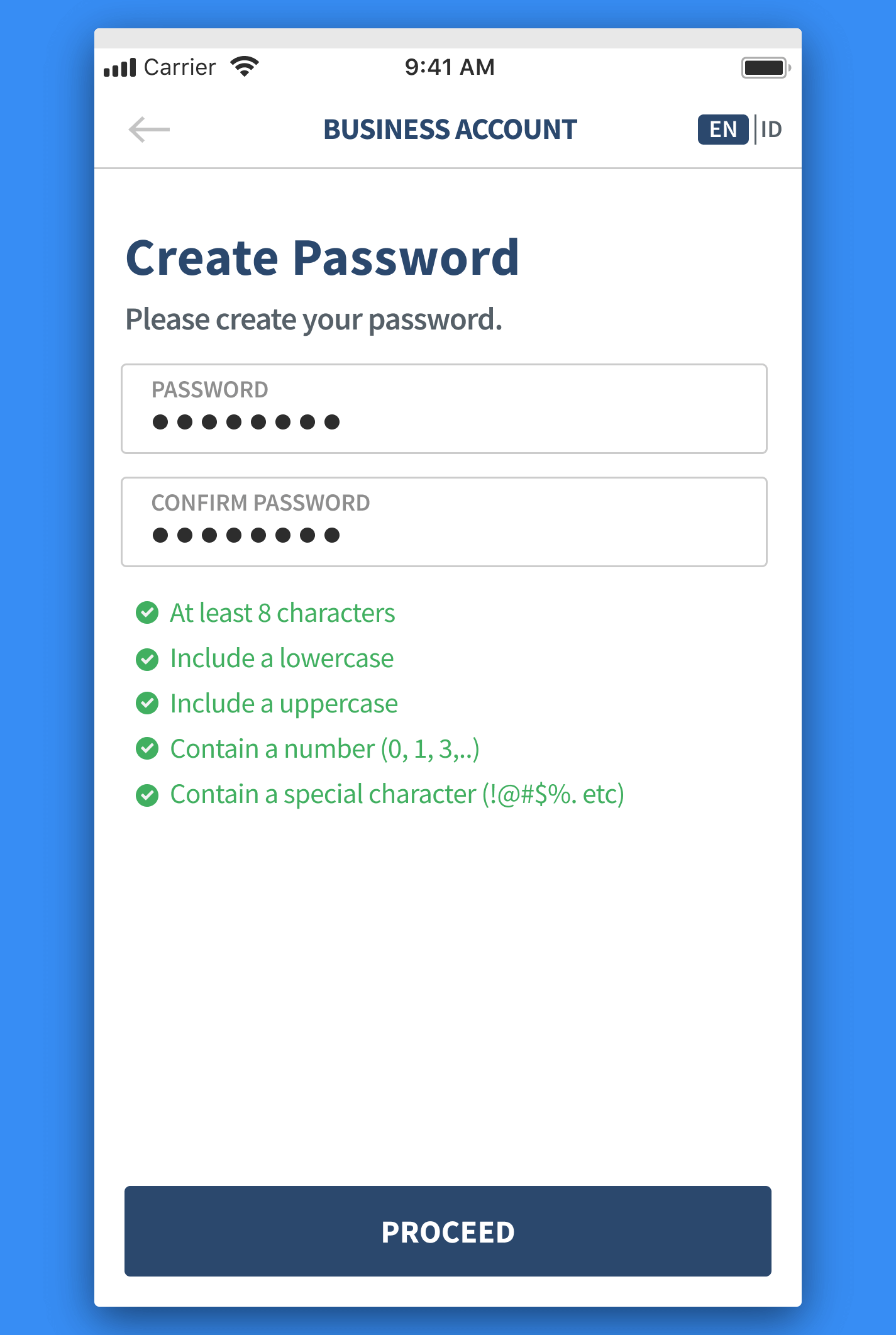

- Create your password

- This is the dashboard that will appear if you have successfully create your business account. You can start applying for business loan now!

Note: If you wish to create more than one account, you can first log out through the “Profile” menu, then repeat the steps above.

2. Sign in to Your Account

- If you only have one account, enter your registered phone number and sign in. But if you have multiple accounts, click on the business account you wish you sign in to

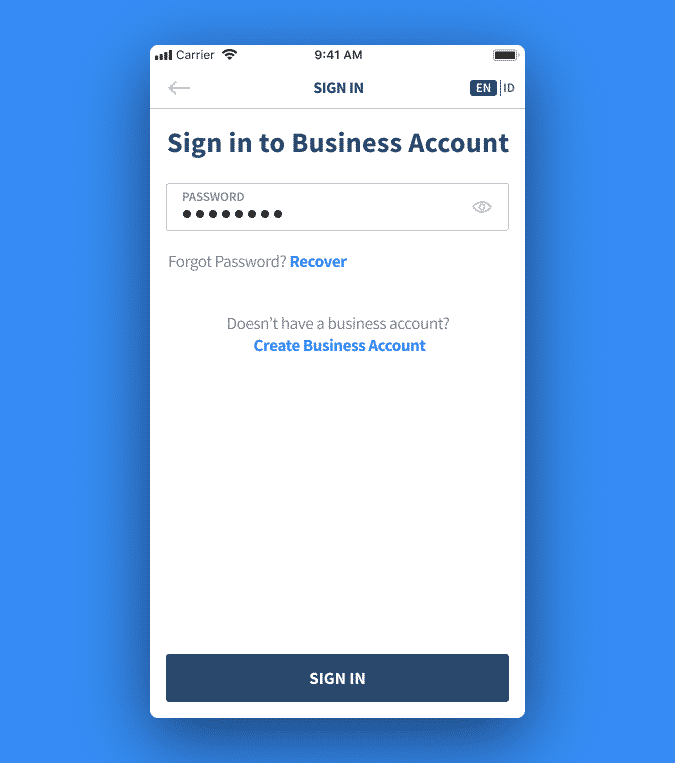

- Enter your password. If you forget it, click “Recover” and you will be directed to recreate new password

- Enter 6 digit OTP code sent to your e-mail. Click “Resend Code” if you don’t receive any message

- Congratulations! You have successfully signing in to you business account.

3. Choose Your Business Loan

1. KoinBisnis

KoinBisnis is business loan service which provided with no collateral which is easy to disbursed and with low rate compared to traditional financial institutions.

Learn more about KoinBisnis here.

2. KoinInvoice

KoinInvoice is a service that provides invoice financing for business development and empowerment of Small and Medium Enterprises (SMEs) with invoices as collateral.

With invoice financing, invoices that were previously unproductive assets can become valuable because they can be used as a source of capital to develop the business.

To use the KoinInvoice service, you must register first here.

Lear more about KoinInvoice here.

4. Apply for Your Business Loan

To apply for a loan at KoinBisnis, there are several documents that you must prepare, such as an ID card, NPWP, Family Card, and account mutations for the last 3 months.

After making sure that all the documents are complete, you can immediately enter the loan nominal and tenor you want, and wait a while until your loan is approved and disbursed.

More information about how to apply for a loan at KoinBisnis, read here.